SERVICES

Insurance A/R ResolutionInsurance

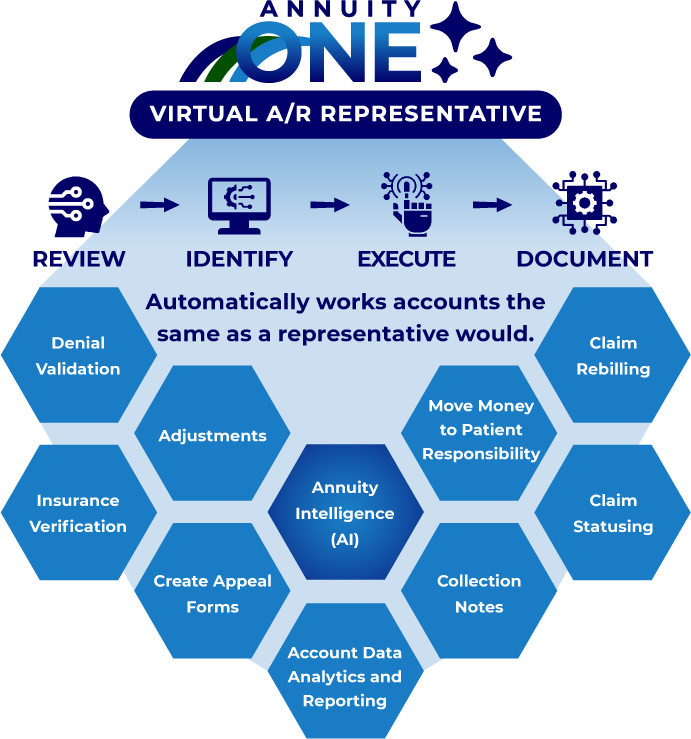

Smart Automation

Drives End-to-End Resolution

Are too many small-balance claims sitting untouched?

Is your team stretched too thin to resolve aging A/R?

Tired of Vendor Smoke and Mirrors “AI” promises with little results?

Faster

%

Quality Rating

Daily Production Per VARR

Doubled workforce capacity

Reduced manual work by 50+%

Faster insurance follow-up

Better claim resolution outcomes

Advanced analytics and intelligent automation

Automate traditionally manual tasks, boosting quality and productivity

Our Intelligent Automation engine, guided by AI analytics, automates low-value and repetitive tasks, enabling staff to focus on complex, high-value accounts for maximum quality and productivity.

Intelligent Automations

✔ Medical Record requests

✔ Appeals processing

✔ Transfer Balance to patient responsibility

Our proprietary technology platform, AnnuityOne, uses an AI bespoke multi-factor, client specific prioritization schema to optimize workflow and queue management, ensuring the right effort for each account. Instead of focusing solely on denial reasons or balance, we factor in payor cash-to-charge ratio, collectability, and cost to collect, among others, to guide the next resolution action.

Specialized Automations

✔ Comprehensive Account Evaluation

✔ Exhaustive Insurance Net Recovery Scoring based on multi-point algorithms

✔ Prescriptive Strategy for delegating tasks to technology vs. people

Success

Case Study

$5b NPR health system

In a rapidly evolving healthcare landscape, efficient revenue cycle management is crucial for sustaining financial health. This case study explores our partnership with a $5 billion NPR health system, where our targeted interventions led to significant financial improvements.

%

Aged AR

>60 Days

%

Cash Collections

From Aged AR = $Millions

%

Client Denials

Leading to corrective ‘up-front’ action